The Future of Financial Services: Embracing Multimodal Search

In an era where digital transformation is reshaping industries, the financial services sector is no exception. As customers increasingly demand seamless, intuitive, and personalized experiences, multimodal search emerges as a game-changing technology. Let’s explore how this innovative approach to information retrieval is revolutionizing the way people interact with financial services.

What is Multimodal Search in Finance?

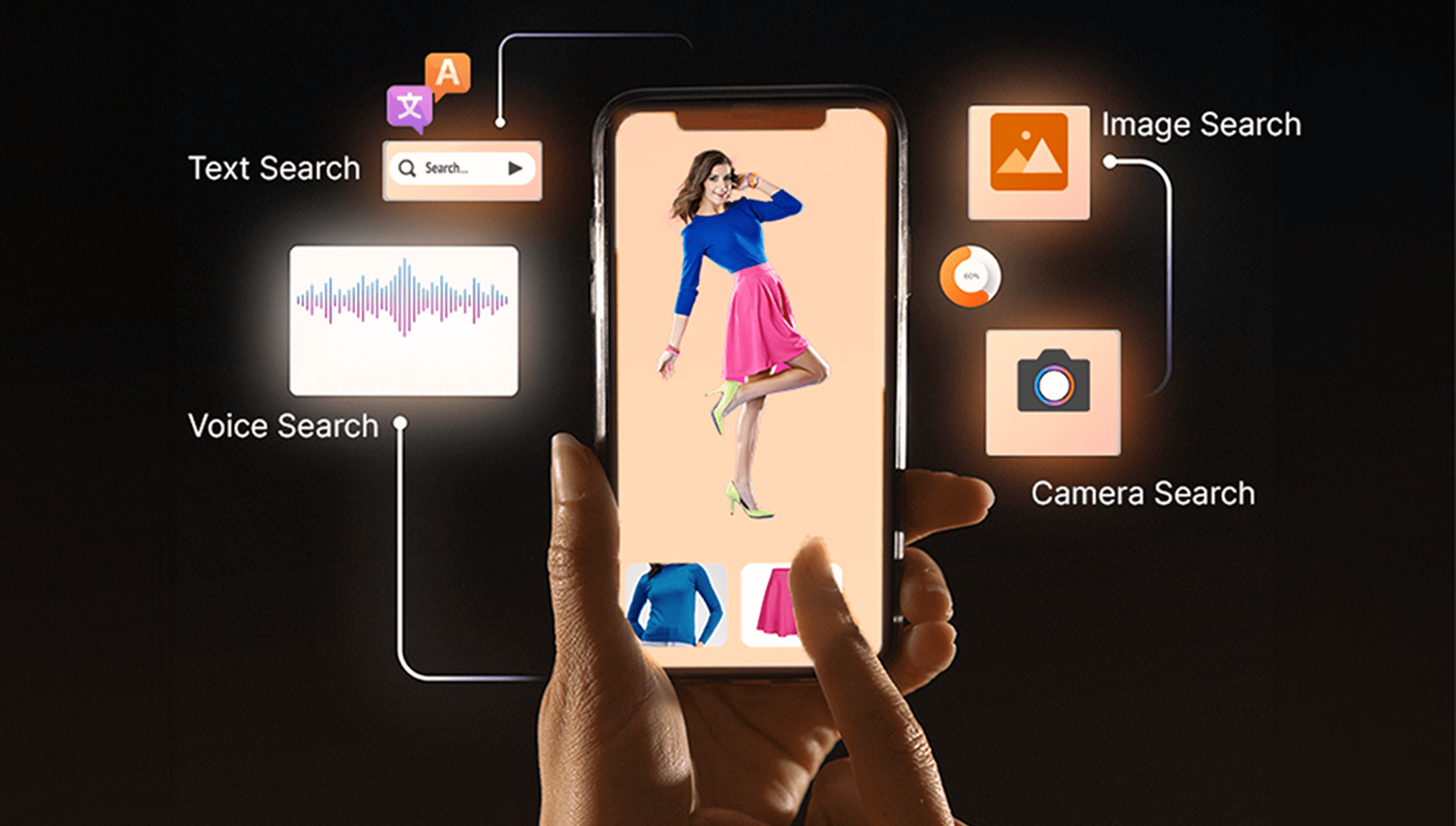

Multimodal search in finance refers to the ability to access financial information and services using various input methods such as text, voice, and contextual data. This technology allows users to interact with financial platforms in ways that are most convenient and natural to them, whether they’re researching the most suitable credit cards, and investment opportunities, or seeking financial advice.

How Multimodal Search Works in Financial Services

Leveraging advanced AI and machine learning algorithms, multimodal search in finance interprets and processes diverse types of input:

- Voice Search: Users can verbally inquire about suitable services and products using natural, conversational language, similar to interacting with a customer support executive on a call.

- Contextual Text Search: The platform is equipped to understand human intent, resulting in clearer guidance on all queries.

- Multilingual Support: Enables users to interact with companies in their preferred language, breaking down barriers in global finance.

Benefits for Financial Institutions

Implementing multimodal search offers numerous advantages for banks, AMCs, fintech, and other financial service providers:

- Improved Customer Satisfaction and Loyalty: Customers can receive instant and personalized responses to their queries and requests, making them feel valued and appreciated.

- Increased Customer Acquisition and Retention: Prospects are more likely to continue their journey with your company and recommend your services to others while existing customers are more inclined to stay.

- Reduced Operational Costs and Increased Efficiency: Your company can save on the costs and resources of hiring and training human advisors, increasing the efficiency and productivity of its customer service and advisory teams.

- Search Optimization: The system can handle various dimensions of user queries, including spelling corrections, synonyms, and specific investment needs, ensuring that search results are as accurate and relevant as possible.

- Competitive Edge: Financial institutions that adopt multimodal search position themselves as innovative leaders in the industry, attracting tech-savvy customers.

Scenarios Based on Industry

- Banks: A potential cardholder who speaks only Hindi uses voice search to ask their query in their preferred mode and language seamlessly. They inquire about suitable credit card options and receive personalized card choices according to the spending habits they mentioned.

- Asset Management Companies: An experienced investor utilizes an investment app’s search bar to find “mutual funds with high growth potential.” The system responds with a curated list of high-performing funds with detailed metrics and risk assessments. The investor can then continue asking for more specific information about different metrics they need regarding the fund.

- Insurers: A young professional searches for “top health insurance plans for young adults” on an insurance company’s website. The search presents plans that are most suited, complete with comprehensive coverage details, premium ranges, and benefit comparisons.

Conclusion

Multimodal search is set to transform the landscape of financial services, offering a more intuitive, efficient, and personalized way for users to manage their finances. By embracing this technology, financial institutions can enhance customer satisfaction, streamline operations, and stay ahead in an increasingly competitive digital environment. As we move toward a more connected and tech-savvy future, the integration of multimodal search in financial services isn’t just an option—it’s a necessity. Financial institutions that adapt to this changing landscape will be well-positioned to meet the evolving needs of their customers and thrive in the digital age of finance.