In an era where digital natives dominate and customers increasingly favor digital-only experiences, banks face growing pressure to simplify how they engage users online. Modern consumers want quick, seamless access to financial products, without the hassle of sifting through confusing or irrelevant information. This shift in behavior underscores the need for robust, context-aware digital solutions that can cater to their needs effectively.

Yet, many banks still rely on outdated, campaign-driven processes. These approaches miss the mark on personalization and fail to deliver accurate, timely information, often resulting in lost opportunities and frustrated customers. Let’s dive into real-life examples of how traditional product discovery for banks fails to meet user intent and why banks must rethink their strategies to stay competitive.

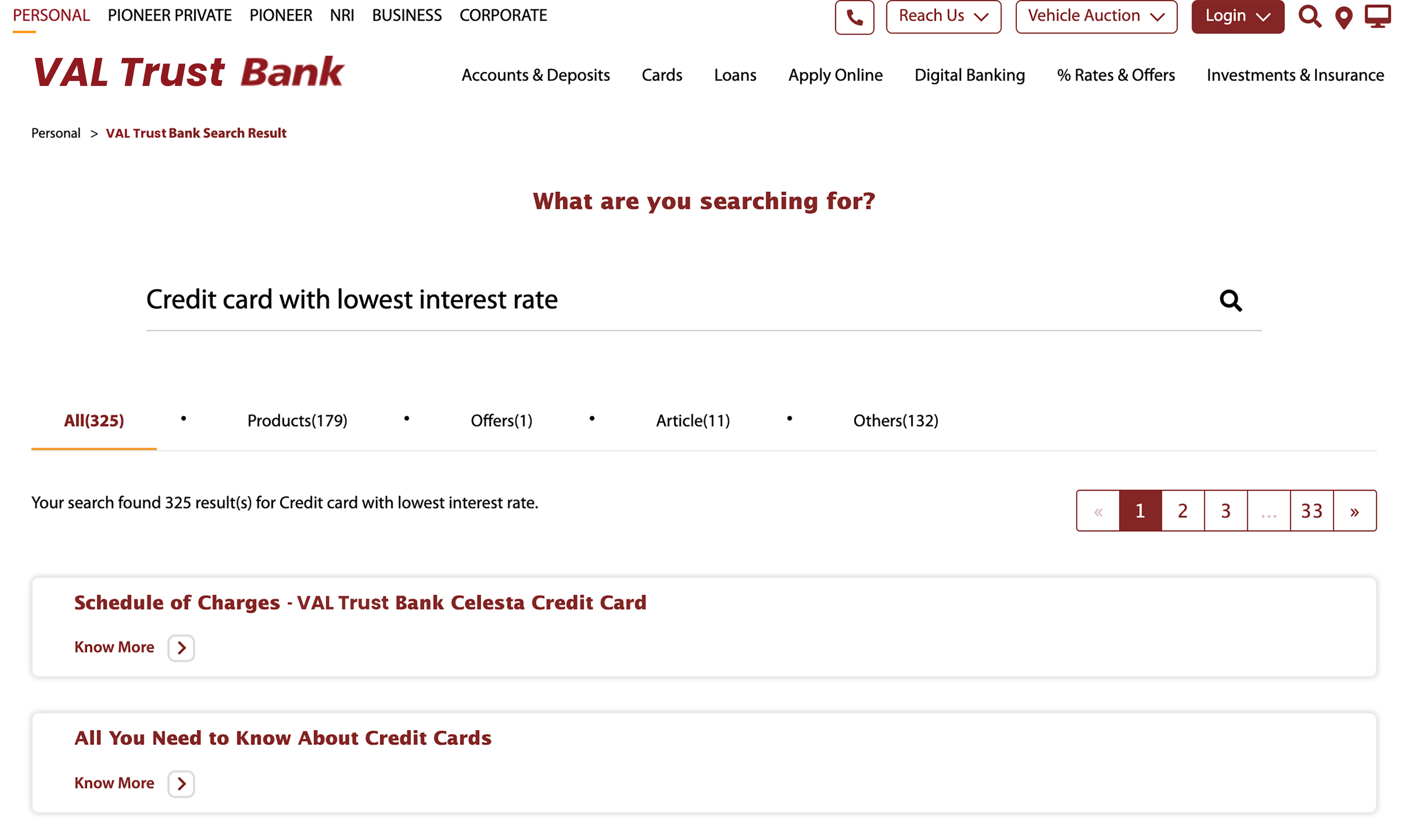

The Costly Pitfalls of Traditional Search

Imagine a Doctor, eager to find a card that fits their lifestyle, enter a particular search query: “credit card with lowest interest rate and includes online shopping rewards points.” This is a highly contextual search — indicating they are looking for a low-cost card with rewards tailored to online shopping.

However, despite this clear intent, the search results are frustratingly generic — featuring credit cards with travel perks, high-interest rates, or rewards unrelated to their needs. Instead of getting personalized options that match their criteria, they face a cluttered list of irrelevant products. Confused and annoyed by the lack of precision, they abandon the process without making a decision. The bank loses a potential customer simply because its search function wasn’t smart enough to cater to the context of the user’s query.

Consider another scenario: A law student planning to further her studies searches for an “education loan with flexible repayment options and low-interest rates.” Once again, this is a contextually rich query — she’s not just looking for any loan but specifically one that offers flexibility and affordability to support her education journey.

Yet, the search results fail to capture her intent. Instead, she’s shown generic loan options like personal loans, high-interest financing, or unrelated student loan products that don’t fit her requirements. The results lack personalization and disregard the context of her query.

The student now faces a lengthy discovery process — hopping from one webpage to another, reading the fine print, or even visiting a branch to get the information she needs. The whole experience drains her time and patience, ultimately, discouraging her from moving forward with that bank.

Why Traditional Product Discovery Falls Short

These examples highlight a critical flaw in traditional product discovery — a lack of context-aware, personalized search results. Despite users providing highly specific search queries, banks’ systems often deliver generic, irrelevant responses. The focus is solely on campaign-driven acquisition, not on delivering real-time, accurate information that matches user intent.

This leads to high acquisition costs, missed conversions, and zero cross-sell or upsell opportunities. To keep up with customer expectations, banks need to rethink their product discovery strategies — embracing intelligent, personalized solutions that can truly understand and cater to the nuanced needs of their customers.

How Generative AI Enhances Customer Product Discovery

Banks must do more than just attract customers; they need to deliver smooth, intuitive experiences that guide users from search to decision-making. Let’s revisit the challenges faced by the engineer and doctor and explore how AI Guided Selling can drastically change the game.

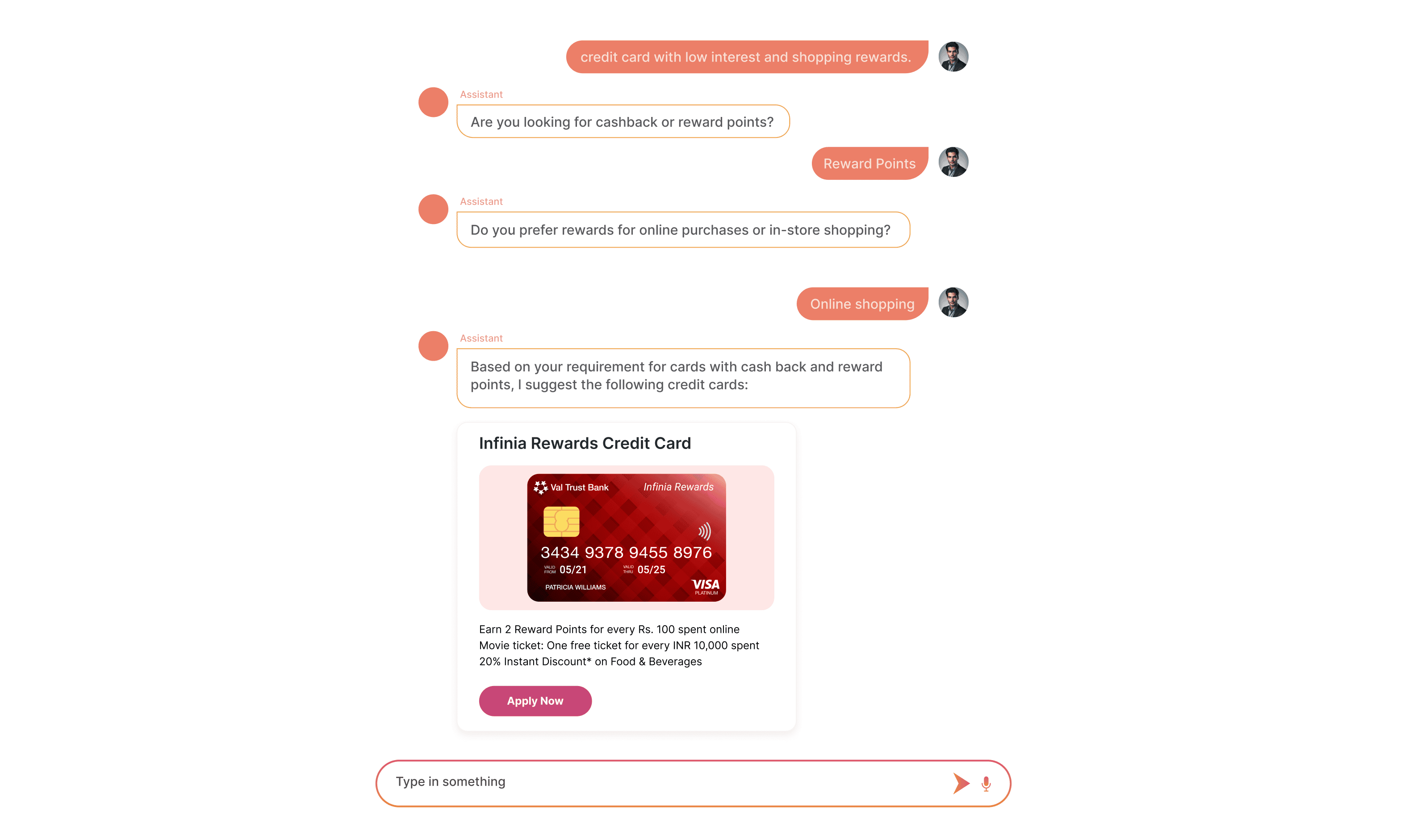

Imagine our Doctor searching again, but this time on the same bank’s website, powered by an AI platform.

Within seconds, the doctor is presented with personalized options: a credit card that offers cashback on online shopping, with the lowest interest rate available. No irrelevant clutter, no confusion — just the perfect match tailored to their exact needs. With AI-guided search, the doctor’s journey is simplified. They’re able to make an informed decision quickly, without being overwhelmed by irrelevant information. This turns what was previously a frustrating experience into a seamless process, improving not only customer satisfaction but also conversion rates.

The Student’s Search for an Education Loan

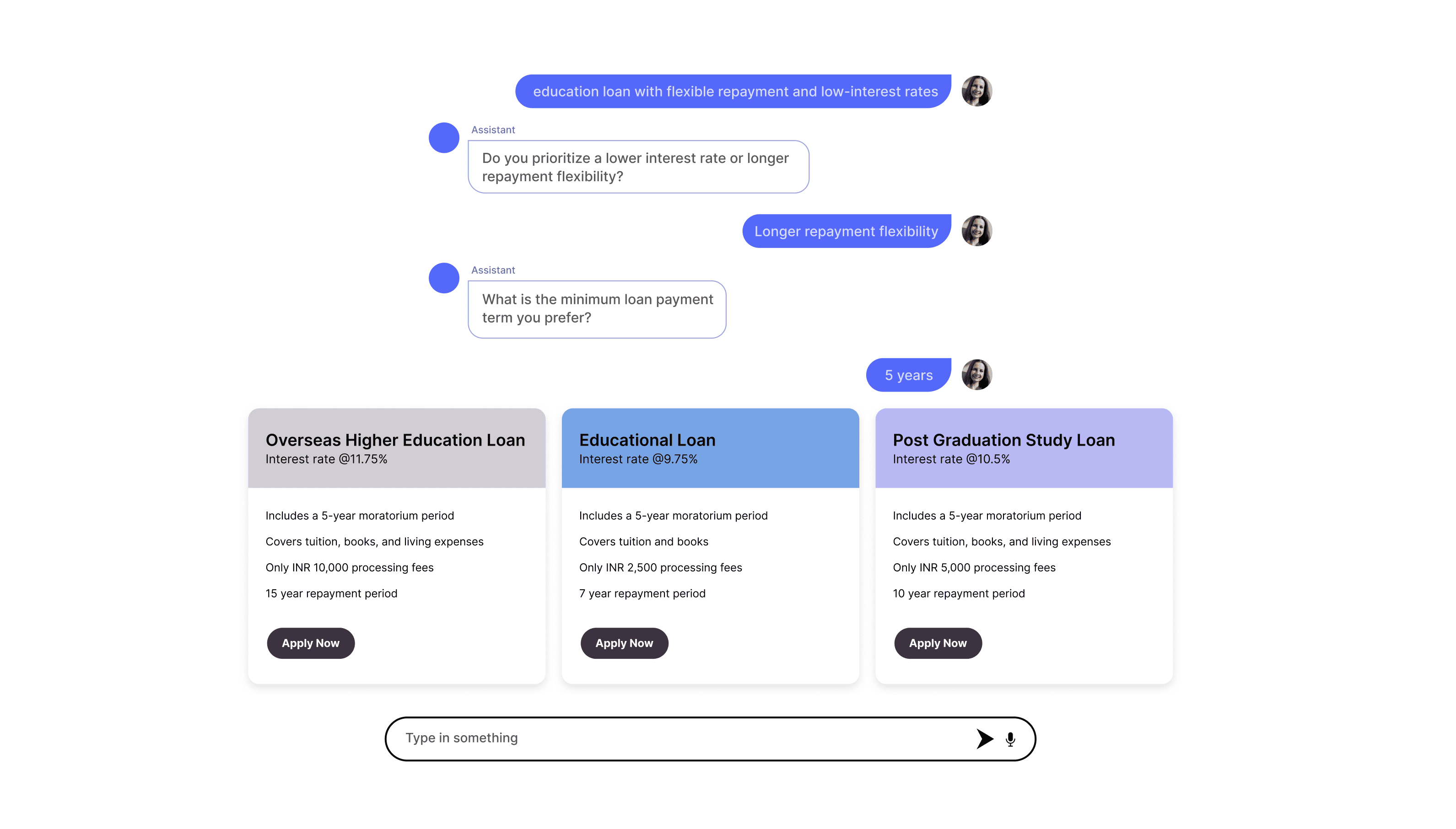

Now, let’s revisit the student seeking an education loan. This time, she entered a search query: “education loan with flexible repayment and low-interest rates.” Instead of generic, irrelevant results, the AI steps in with smart prompts.

In just a few interactions, the student is guided to a personalized loan that fits her requirements. The discovery process, which previously took hours or even days, is shortened to mere minutes. This is the power of AI-driven search — it understands the user’s intent, asks relevant questions, and delivers precisely what the customer is looking for.

Why Guided Selling is a Game-Changer for Banks

The traditional product discovery process is not just outdated — it’s ineffective. By focusing purely on campaign-driven acquisition, banks miss out on providing the context-rich, personalized experiences that modern consumers expect.

AI-powered solutions, on the other hand, transform product discovery into a guided journey.

Here’s how:

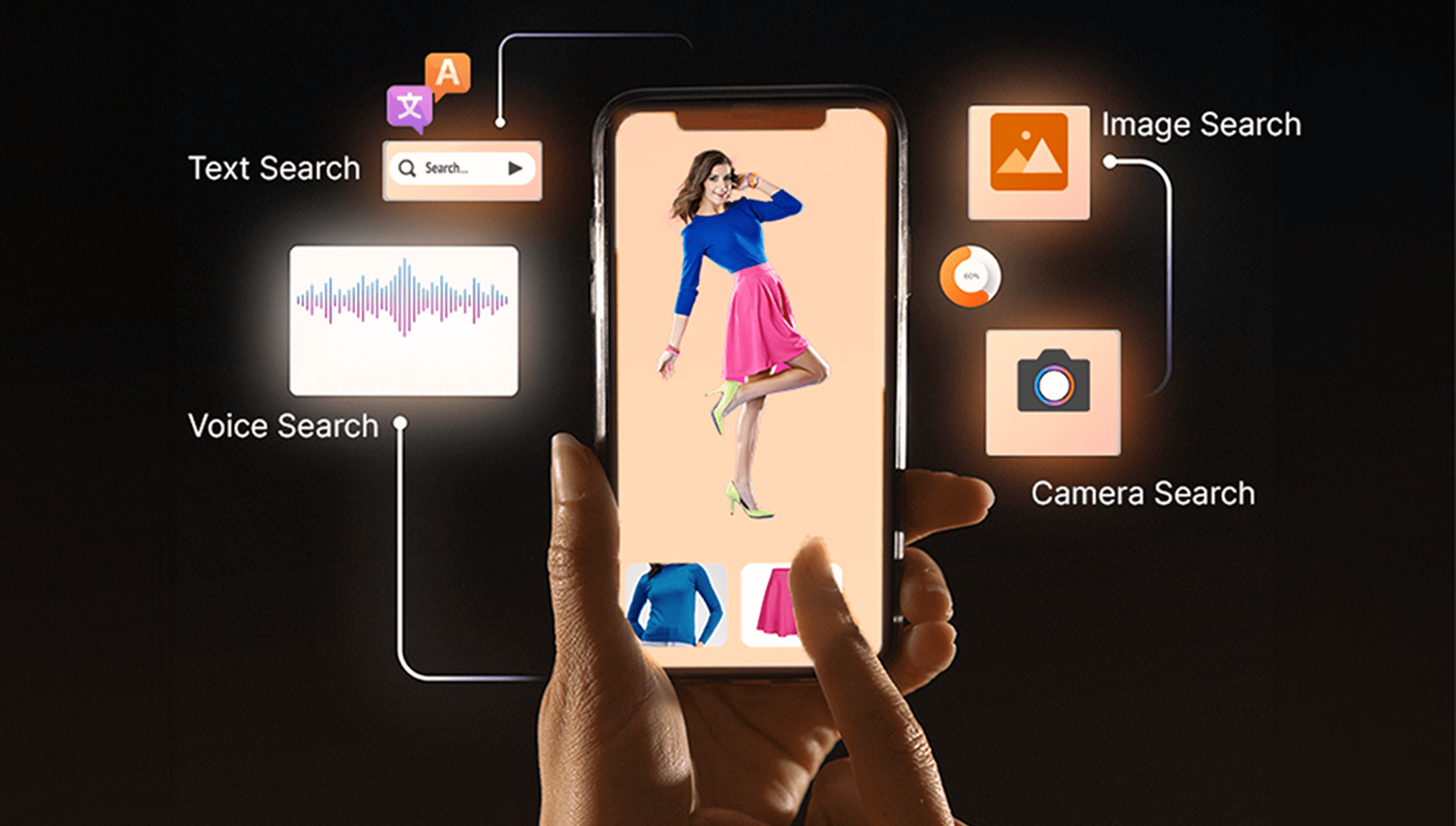

- Understanding User Intent: Instead of relying on static search algorithms, AI uses natural language processing to understand the real context behind a user’s query. This ensures that users get personalized results that align with their specific needs.

- Guided Conversations: By using prompts to clarify intent, AI helps customers refine their preferences on the go. This eliminates the need for lengthy searches and leads to faster, more accurate product matches.

- Shortening the Discovery Process: What used to be a frustrating, time-consuming journey is now streamlined into a quick, conversational experience. AI helps users make confident decisions quickly, reducing drop-offs and driving higher conversions.

The Future of Banking: Smarter, Faster, More Personal

As banks continue to evolve, integrating AI into product discovery isn’t just a nice-to-have — it’s a must. With AI-guided search and personalized recommendations, banks can transform confused shoppers into satisfied customers, all while reducing acquisition costs and increasing cross-sell opportunities.

By leveraging AI AI-guided selling, banks can finally deliver the seamless, intuitive experiences that today’s digital-first customers demand. It’s time to move beyond traditional campaigns and embrace the future of a personalized, data-driven approach to product discovery.

Explore how Flyfish can revolutionize your product discovery strategy. Connect with our expert team!