Banks are under constant pressure to not just meet but exceed customer expectations. Sales teams are at the frontline, juggling the need to understand customer requirements, provide relevant solutions, and navigate a maze of regulatory compliance. The traditional way of manually digging through data to find customer-specific information is slow, error-prone, and frankly, outdated.

- High Customer Churn: Each year, banks and financial institutions actively lose 25 to 30 percent of their customers. AI sales assist helps reps better understand customer needs and ultimately retain satisfied customers.

- Slow Onboarding: Traditionally, training new sales reps can take months. They need to memorize product details, regulations, and internal policies. Hence, AI sales assist acts as a real-time knowledge base, allowing reps to close deals faster and become productive quickly.

- Information Bottlenecks: Banking regulations and products change constantly, and sales reps often struggle to access the latest information. Thus, AI sales assist provides instant access to up-to-date memos, product details, and compliance guidelines. This ensures reps have the most accurate information at their fingertips.

Having said that, exceptional customer experiences hold significant potential. A report by Retaildrive states that 73% of customers walk away from brands that don’t make them feel valued.

But how do you deliver top-notch service when your sales reps are drowning in information overload?

Streamlining Customer Experience with GenAI

The banking world has seen its fair share of technological shifts. Now, generative AI in banking is the latest trend, and it is making waves in the industry.

Imagine Ram asking about credit card options at his bank. Traditionally, a sales rep would manually search through multiple systems and documents to answer, a time-consuming process that could lead to a fragmented customer experience.

In the traditional banking setup, the sales representative assisting Ram would have to manually sift through multiple systems, databases, and possibly hard-copy manuals or documents to gather all the information Sarah needs.

These could include:

- Credit Card Features: Looking up various cards to match Ram’s spending habits and rewards preferences.

- Interest Rates and Fees: Find the current interest rate for each card, including any special offers or conditions.

- Eligibility Criteria: Checking Ram’s eligibility based on bank criteria, which may involve accessing different systems or software.

This process is not only time-consuming, eating into both Ram’s and the sales representative’s time, but it’s also prone to errors and omissions. Each moment spent searching for information or double-checking details creates a disjointed and frustrating experience for Ram, who is left waiting for answers.

Is Generative AI capable of solving this?

Absolutely, the answer is YES! With the revolutionary GenAI platform Flyfish, the moment Ram inputs his requirements, he’s presented with customized card options, up-to-the-minute rates, and a clear view of his eligibility. This isn’t just about saving time—it’s about delivering accurate, personalized information instantly.

For the sales agent, this transformation through AI sales assistance turns a process that used to be slow and prone to errors into a swift, seamless, and satisfying experience. Banking inquiries, much like Sarah’s, become smoother and vastly more efficient. Furthermore, AI sales assistance stands as a beacon of transparency, ensuring that representatives have the tools to provide accurate and informed information.

In essence, this technology is not just enhancing customer interactions; it’s redefining them, allowing users to enjoy a level of service that’s not just fast, but remarkably intuitive.

Elevating Trust in Banking with AI

Remember the infamous Citibank scandal? Marked by deceptive sales tactics?

AI sales assist technology like Flyfish is the response, reigning in transparency and empowering sales reps to provide accurate and informed information. This evolution doesn’t just streamline and enhance customer experiences but also serves as a pillar of integrity in customer interactions. By prioritizing transparency and informed communication, AI-driven platforms are ensuring a future free from the shadows of misinformation and coercive sales strategies.

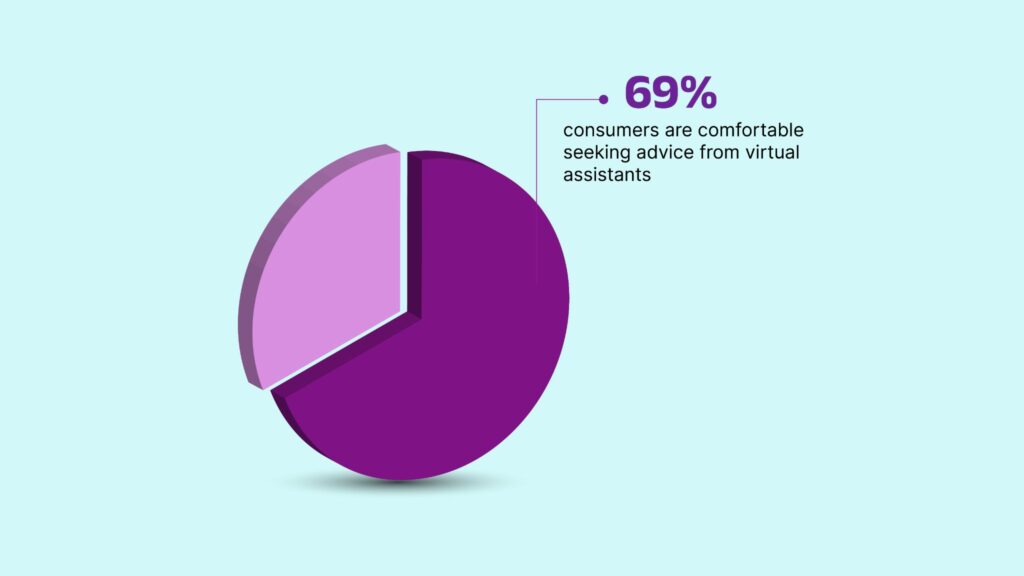

A recent study shows that 69% of consumers are comfortable seeking advice from virtual assistants.

The following table highlights the successful implementations of AI sales assist technologies in various banks. It showcases the tangible benefits they have realized from these implementations.

| Bank | AI sales assist Implementation | Values |

| JP Morgan Chase | COIN (Contract Intelligence) for interpreting loan agreements | Streamlining loan agreement interpretation and processing. |

| Bank of America | Erica is a virtual assistant for various banking tasks | Enhancing customer experience through AI-driven support. |

| HSBC | AI algorithms for personalized wealth management services | Providing tailored wealth management solutions for clients. |

Ajay Banga, former CEO of Mastercard, famously said, “Innovation is not just about having a good idea. It’s about executing on that idea and creating value for customers and society.”

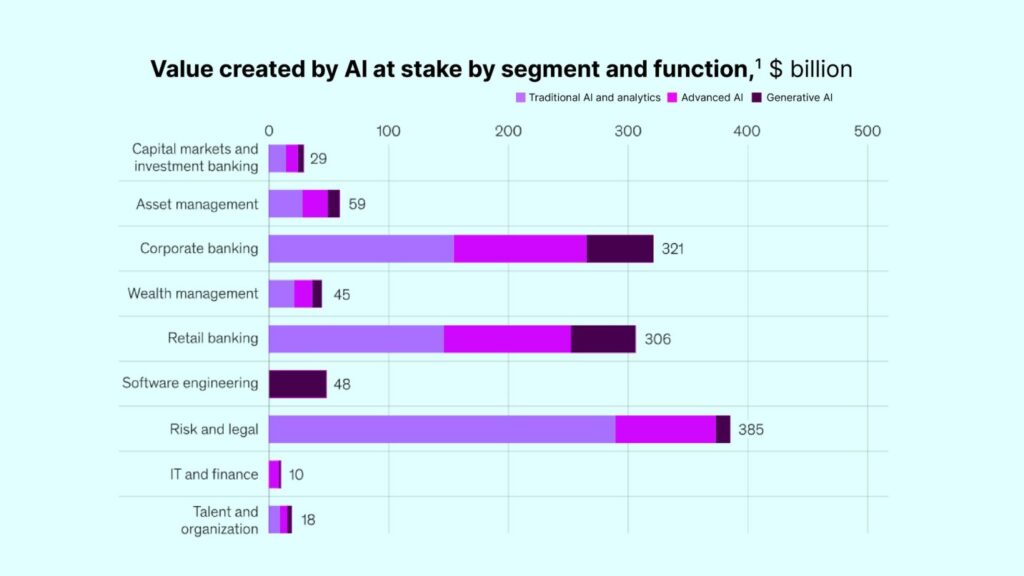

AI sales assist is about adopting innovation to empower your sales force, revolutionize customer interactions, & push your bank to the forefront of the industry. As such, the potential rewards of generative AI in banking are staggering—studies estimate that generative AI could open a staggering $200 billion to $340 billion in value for banks.

Source: McKinsey

The Emergence of AI-Powered Sales in Banking

Let’s be honest: AI hasn’t quite become the silver bullet for banking. While it’s transforming other areas, sales teams are still waiting for a game-changer. But that doesn’t mean AI can’t be a powerful tool. There are ways banks can close the divide and utilize AI to power up their assisted and self-service sales:

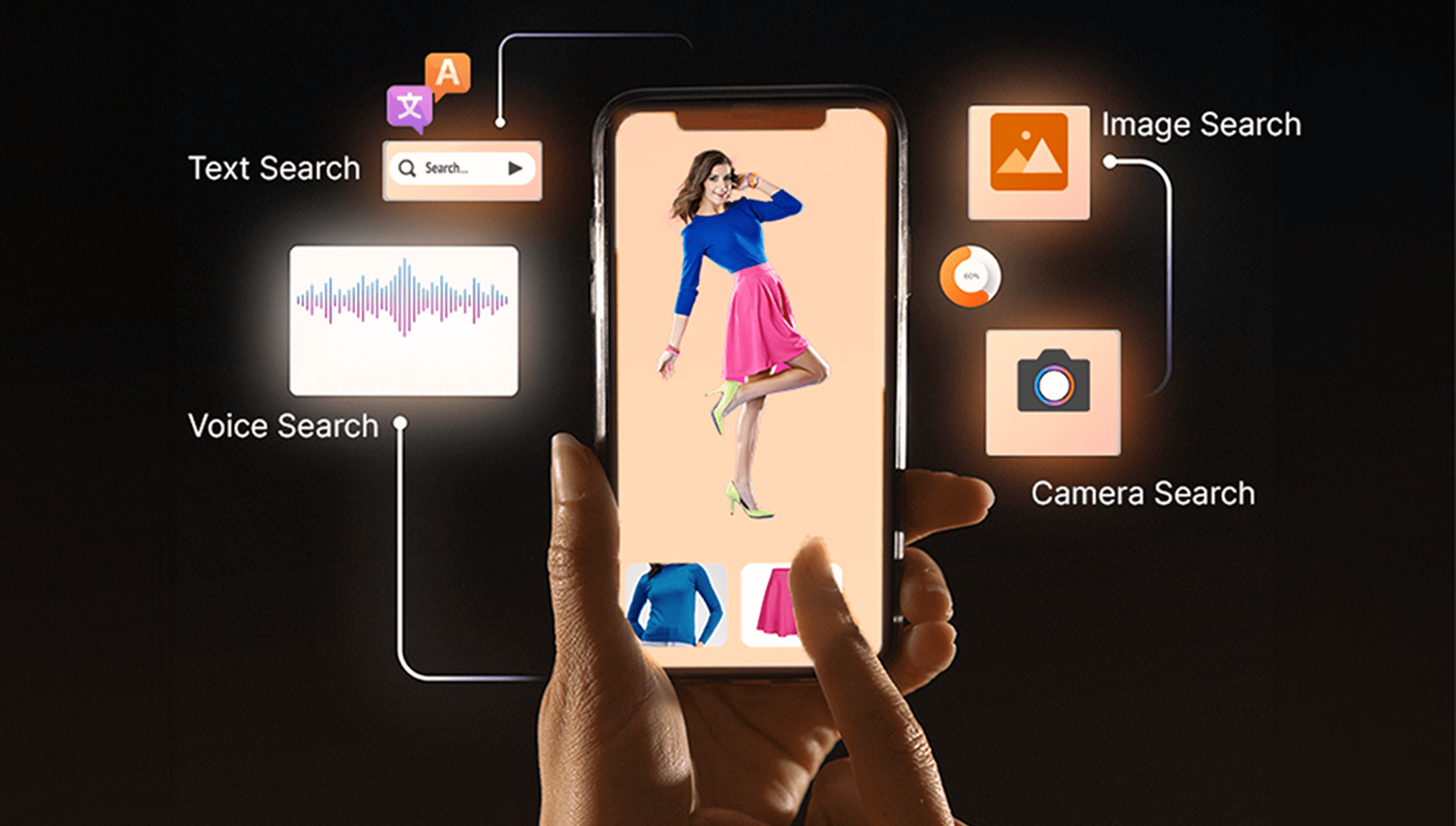

Broken search in Banking: Implementing AI to improve search functionality in banking addresses the broken aspect of online searches. For example, AI ensures seamless online credit card purchases by guiding customers and facilitating assistance from sales reps, enhancing transaction experiences.

Know Your Customers Better: AI can analyze mountains of customer data – spending habits, demographics, financial goals – to predict their needs with laser focus. Imagine a virtual assistant automatically recommending a high-yield savings account to a customer who is consistently saving. Pretty cool, right?

Stop Wasting Time on Window Shopping: AI can qualify leads in real time, flagging high-potential customers and prioritizing them for sales reps. This cuts through the noise, ensuring reps focus on the most profitable opportunities.

Many big banks like JPMorgan Chase, Bank of America, and DBS are using AI technology. These “smart machines” help them catch fraud better, suggest the right products for each customer, and make getting loans faster. All this adds up to an easier and safer banking experience for everyone.

Remember: “AI isn’t here to replace your sales team. It’s here to make them smarter, personalize customer experiences, and ultimately drive sales growth across both assisted and self-serve channels.”

Generative AI in banking sales is transforming the way banks interact with customers. Enabling banks to craft personalized recommendations, efficient lead nurturing, and a constantly improving customer experience. However, choosing the most suitable AI sales assistant is crucial. Don’t settle for just average results in your bank’s sales. Outsmart the competition with Flyfish – schedule a demo today!