Imagine you’re an investor exploring asset management options. You’re bombarded with jargon, overwhelmed by endless product details, and left unsure about what’s best for your financial goals.

Asset Management Companies (AMCs) know this pain point all too well. With vast product portfolios, constantly evolving regulations, and diverse customer needs, guiding investors through their journey can feel like navigating a maze. To stay competitive, AMCs must deliver a seamless, personalized, and efficient advisory experience. Yet, the reality is that most struggle with:

- Slow response times: Inaccurate or delayed information hampers investor trust.

- Fragmented search experiences: Websites often lack intuitive search capabilities, leading to missed opportunities for conversions.

- Overloaded internal teams: Advisors spend too much time searching for answers instead of engaging with clients.

- This disconnect not only frustrates investors but also leaves AMCs with lost opportunities to build loyalty and grow their client base.

Navigating Investor Complexity in a Digital World

AMCs have diverse portfolios, each tailored to different investor profiles, risk appetites, and financial goals. The challenge is ensuring investors find the right products quickly while adhering to regulatory guidelines.

Let’s explore how these challenges play out in real-world scenarios:

- Jane, a novice investor, is new to investing and wants to start small. She searches online for “beginner-friendly mutual funds” but is met with pages of confusing financial terms. Frustrated, she leaves the website without investing. Jane needs personalized guidance, educational content, and a clear path forward.

- Sarah, a young professional, is focused on high-growth funds to align with her career goals. She visits the AMC’s website but struggles to find funds tailored to her risk profile and timeline. Sarah seeks specific investment options that align with her future plans but finds generic content instead.

- John is an experienced investor looking to diversify his portfolio. He wants detailed performance data and projections but ends up wasting time sifting through irrelevant search results. Experienced investors like John often have specific preferences, such as risk tolerance, historical performance, market conditions, and insights into fund managers’ historical portfolios, which Flyfish can address effectively. John needs accurate, detailed information fast but faces a clunky search experience.

- Emily prioritizes ESG (Environmental, Social, and Governance) funds. She visits the AMC’s site searching for “green mutual funds” but finds it challenging to identify options aligned with her values. Emily’s specific preferences are not catered to, making it difficult for her to invest confidently.

High Growth for Asset Management Begins with Generative AI

This is where Flyfish’s AI-powered multimodal search and guided selling solution comes into play. By leveraging the power of Generative AI, Flyfish enables AMCs to transform investor experiences, drive engagement, and increase conversions.

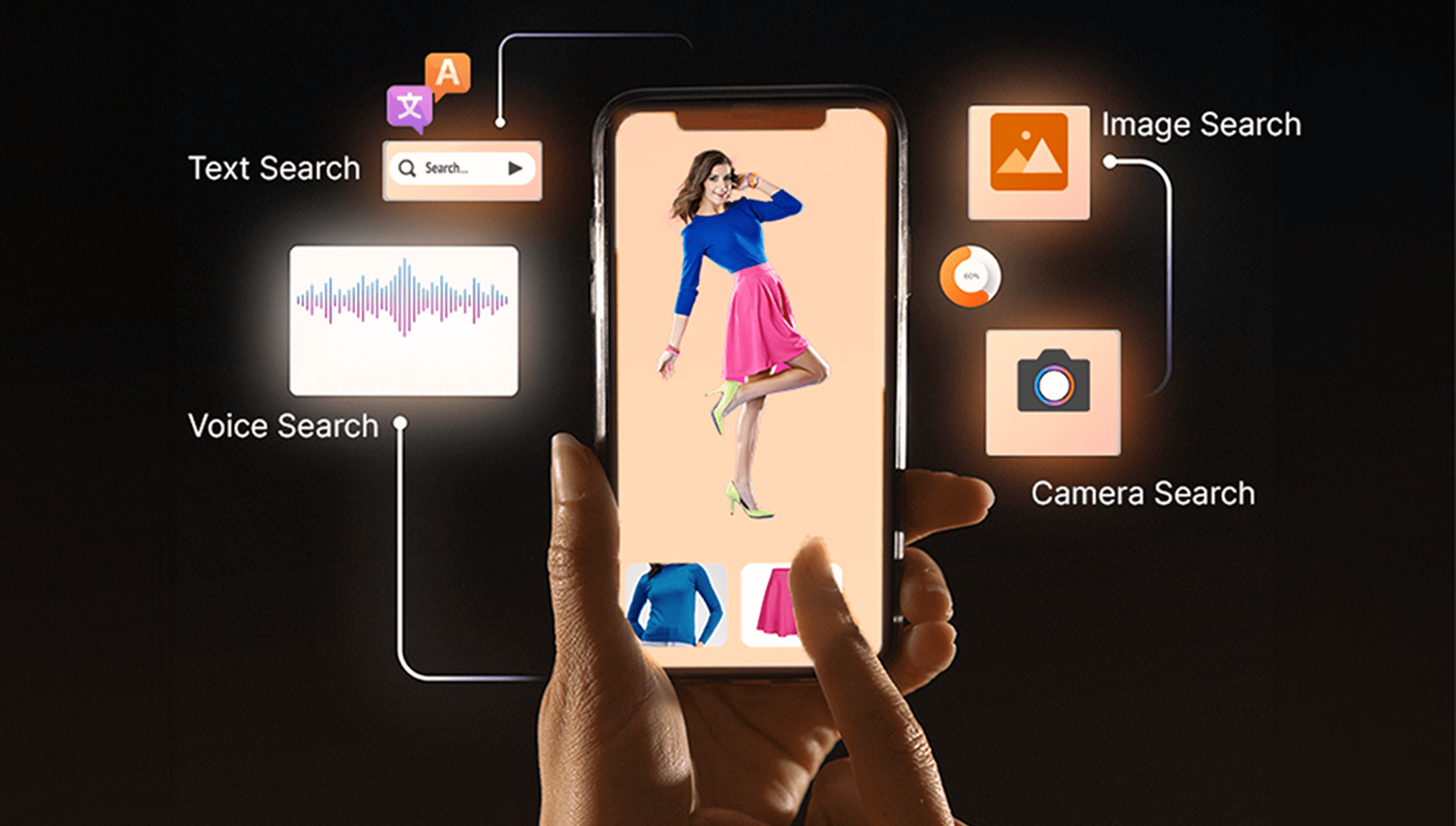

Personalized, Intent-Driven Search

Flyfish’s multimodal AI engine understands the context behind investor queries, delivering precise, personalized search results. Whether it’s Jane looking for beginner funds or John seeking diversification options, the AI tailors results based on the user’s profile, investment goals, and risk appetite.

AI-Powered Guided Selling

The platform’s guided selling capabilities help investors navigate their financial journey with confidence. For instance, if Sarah is interested in high-growth funds, the AI suggests products based on her profile, timeline, risk appetite, and investment goals, while ensuring compliance by focusing on educational insights.

Contextual Assistance & Recommendations

The AI-powered advisor can handle complex queries, provide step-by-step investment guidance, and offer follow-up resources. For Emily, who cares about socially responsible investments, the AI filters and showcases ESG funds with relevant performance data, making it easy for her to invest with confidence.

Multilingual & Omni-Channel Support

Flyfish’s solution works seamlessly across websites, mobile apps, and chat interfaces, supporting multiple languages. This is increasingly important as local news agencies and vernacular channels now dedicate time to financial education, sparking growing interest in tier 2 and tier 3 cities. By enhancing accessibility and addressing this rising demand for local language support, AMCs can engage clients in their preferred language, building trust, satisfaction, and loyalty among this emerging investor segment.

In today’s digital landscape, providing an efficient, personalized, and compliant advisory experience isn’t just a competitive edge — it’s a necessity. Let Flyfish empower your AMC with AI. Get in touch today for a personalized demo and see the transformation for yourself!